10. Geometric Series for Elementary Economics#

10.1. Overview#

The lecture describes important ideas in economics that use the mathematics of geometric series.

Among these are

the Keynesian multiplier

the money multiplier that prevails in fractional reserve banking systems

interest rates and present values of streams of payouts from assets

(As we shall see below, the term multiplier comes down to meaning sum of a convergent geometric series)

These and other applications prove the truth of the wise crack that

“In economics, a little knowledge of geometric series goes a long way.”

Below we’ll use the following imports:

import matplotlib.pyplot as plt

plt.rcParams["figure.figsize"] = (11, 5) #set default figure size

import numpy as np

import sympy as sym

from sympy import init_printing

from matplotlib import cm

10.2. Key formulas#

To start, let be a real number that lies strictly between and .

We often write this as .

Here denotes the collection of all real numbers that are strictly less than and strictly greater than .

The symbol means in or belongs to the set after the symbol.

We want to evaluate geometric series of two types – infinite and finite.

10.2.1. Infinite geometric series#

The first type of geometric that interests us is the infinite series

Where means that the series continues without end.

The key formula is

To prove key formula (10.1), multiply both sides by and verify that if , then the outcome is the equation .

10.2.2. Finite geometric series#

The second series that interests us is the finite geometric series

where is a positive integer.

The key formula here is

Remark 10.1

The above formula works for any value of the scalar . We don’t have to restrict to be in the set .

We now move on to describe some famous economic applications of geometric series.

10.3. Example: The Money Multiplier in Fractional Reserve Banking#

In a fractional reserve banking system, banks hold only a fraction of cash behind each deposit receipt that they issue

In recent times

cash consists of pieces of paper issued by the government and called dollars or pounds or

a deposit is a balance in a checking or savings account that entitles the owner to ask the bank for immediate payment in cash

When the UK and France and the US were on either a gold or silver standard (before 1914, for example)

cash was a gold or silver coin

a deposit receipt was a bank note that the bank promised to convert into gold or silver on demand; (sometimes it was also a checking or savings account balance)

Economists and financiers often define the supply of money as an economy-wide sum of cash plus deposits.

In a fractional reserve banking system (one in which the reserve ratio satisfies ), banks create money by issuing deposits backed by fractional reserves plus loans that they make to their customers.

A geometric series is a key tool for understanding how banks create money (i.e., deposits) in a fractional reserve system.

The geometric series formula (10.1) is at the heart of the classic model of the money creation process – one that leads us to the celebrated money multiplier.

10.3.1. A simple model#

There is a set of banks named .

Bank ’s loans , deposits , and reserves must satisfy the balance sheet equation (because balance sheets balance):

The left side of the above equation is the sum of the bank’s assets, namely, the loans it has outstanding plus its reserves of cash .

The right side records bank ’s liabilities, namely, the deposits held by its depositors; these are IOU’s from the bank to its depositors in the form of either checking accounts or savings accounts (or before 1914, bank notes issued by a bank stating promises to redeem notes for gold or silver on demand).

Each bank sets its reserves to satisfy the equation

where is its reserve-deposit ratio or reserve ratio for short

the reserve ratio is either set by a government or chosen by banks for precautionary reasons

Next we add a theory stating that bank ’s deposits depend entirely on loans made by bank , namely

Thus, we can think of the banks as being arranged along a line with loans from bank being immediately deposited in

in this way, the debtors to bank become creditors of bank

Finally, we add an initial condition about an exogenous level of bank ’s deposits

We can think of as being the amount of cash that a first depositor put into the first bank in the system, bank number .

Now we do a little algebra.

Combining equations (10.2) and (10.3) tells us that

This states that bank loans a fraction of its deposits and keeps a fraction as cash reserves.

Combining equation (10.5) with equation (10.4) tells us that

which implies that

Equation (10.6) expresses as the th term in the product of and the geometric series

Therefore, the sum of all deposits in our banking system is

10.3.2. Money multiplier#

The money multiplier is a number that tells the multiplicative factor by which an exogenous injection of cash into bank leads to an increase in the total deposits in the banking system.

Equation (10.7) asserts that the money multiplier is

An initial deposit of cash of in bank leads the banking system to create total deposits of .

The initial deposit is held as reserves, distributed throughout the banking system according to .

10.4. Example: The Keynesian Multiplier#

The famous economist John Maynard Keynes and his followers created a simple model intended to determine national income in circumstances in which

there are substantial unemployed resources, in particular excess supply of labor and capital

prices and interest rates fail to adjust to make aggregate supply equal demand (e.g., prices and interest rates are frozen)

national income is entirely determined by aggregate demand

10.4.1. Static version#

An elementary Keynesian model of national income determination consists of three equations that describe aggregate demand for and its components.

The first equation is a national income identity asserting that consumption plus investment equals national income :

The second equation is a Keynesian consumption function asserting that people consume a fraction of their income:

The fraction is called the marginal propensity to consume.

The fraction is called the marginal propensity to save.

The third equation simply states that investment is exogenous at level .

exogenous means determined outside this model.

Substituting the second equation into the first gives .

Solving this equation for gives

The quantity is called the investment multiplier or simply the multiplier.

Applying the formula for the sum of an infinite geometric series, we can write the above equation as

where is a nonnegative integer.

So we arrive at the following equivalent expressions for the multiplier:

The expression motivates an interpretation of the multiplier as the outcome of a dynamic process that we describe next.

10.4.2. Dynamic version#

We arrive at a dynamic version by interpreting the nonnegative integer as indexing time and changing our specification of the consumption function to take time into account

we add a one-period lag in how income affects consumption

We let be consumption at time and be investment at time .

We modify our consumption function to assume the form

so that is the marginal propensity to consume (now) out of last period’s income.

We begin with an initial condition stating that

We also assume that

so that investment is constant over time.

It follows that

and

and

and more generally

or

Evidently, as ,

Remark 1: The above formula is often applied to assert that an exogenous increase in investment of at time ignites a dynamic process of increases in national income by successive amounts

at times .

Remark 2 Let be an exogenous sequence of government expenditures.

If we generalize the model so that the national income identity becomes

then a version of the preceding argument shows that the government expenditures multiplier is also , so that a permanent increase in government expenditures ultimately leads to an increase in national income equal to the multiplier times the increase in government expenditures.

10.5. Example: Interest Rates and Present Values#

We can apply our formula for geometric series to study how interest rates affect values of streams of dollar payments that extend over time.

We work in discrete time and assume that indexes time.

We let be a one-period net nominal interest rate

if the nominal interest rate is percent, then

A one-period gross nominal interest rate is defined as

if , then

Remark: The gross nominal interest rate is an exchange rate or relative price of dollars at between times and . The units of are dollars at time per dollar at time .

When people borrow and lend, they trade dollars now for dollars later or dollars later for dollars now.

The price at which these exchanges occur is the gross nominal interest rate.

If I sell dollars to you today, you pay me dollars tomorrow.

This means that you borrowed dollars for me at a gross interest rate and a net interest rate .

We assume that the net nominal interest rate is fixed over time, so that is the gross nominal interest rate at times .

Two important geometric sequences are

and

Sequence (10.8) tells us how dollar values of an investment accumulate through time.

Sequence (10.9) tells us how to discount future dollars to get their values in terms of today’s dollars.

10.5.1. Accumulation#

Geometric sequence (10.8) tells us how one dollar invested and re-invested in a project with gross one period nominal rate of return accumulates

here we assume that net interest payments are reinvested in the project

thus, dollar invested at time pays interest dollars after one period, so we have dollars at time

at time we reinvest dollars and receive interest of dollars at time plus the principal dollars, so we receive dollars at the end of period

and so on

Evidently, if we invest dollars at time and reinvest the proceeds, then the sequence

tells how our account accumulates at dates .

10.5.2. Discounting#

Geometric sequence (10.9) tells us how much future dollars are worth in terms of today’s dollars.

Remember that the units of are dollars at per dollar at .

It follows that

the units of are dollars at per dollar at

the units of are dollars at per dollar at

and so on; the units of are dollars at per dollar at

So if someone has a claim on dollars at time , it is worth dollars at time (e.g., today).

10.5.3. Application to asset pricing#

A lease requires a payments stream of dollars at times where

where and .

Thus, lease payments increase at percent per period.

For a reason soon to be revealed, we assume that .

The present value of the lease is

where the last line uses the formula for an infinite geometric series.

Recall that and and that and and that and are typically small numbers, e.g., .05 or .03.

Use the Taylor series of about , namely,

and the fact that is small to approximate .

Use this approximation to write as

where the last step uses the approximation .

The approximation

is known as the Gordon formula for the present value or current price of an infinite payment stream when the nominal one-period interest rate is and when .

We can also extend the asset pricing formula so that it applies to finite leases.

Let the payment stream on the lease now be for , where again

The present value of this lease is:

Applying the Taylor series to about we get:

Similarly, applying the Taylor series to about :

Thus, we get the following approximation:

Expanding:

We could have also approximated by removing the second term when is relatively small compared to to get as in the finite stream approximation.

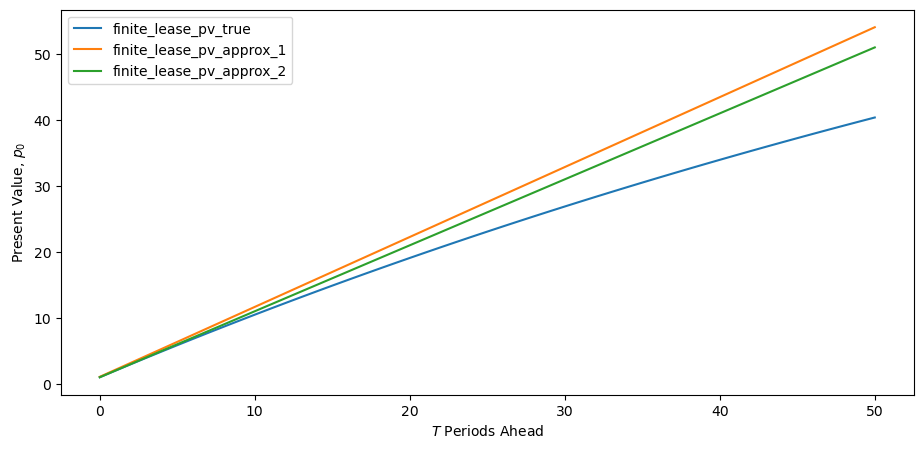

We will plot the true finite stream present-value and the two approximations, under different values of , and and in Python.

First we plot the true finite stream present-value after computing it below

# True present value of a finite lease

def finite_lease_pv_true(T, g, r, x_0):

G = (1 + g)

R = (1 + r)

return (x_0 * (1 - G**(T + 1) * R**(-T - 1))) / (1 - G * R**(-1))

# First approximation for our finite lease

def finite_lease_pv_approx_1(T, g, r, x_0):

p = x_0 * (T + 1) + x_0 * r * g * (T + 1) / (r - g)

return p

# Second approximation for our finite lease

def finite_lease_pv_approx_2(T, g, r, x_0):

return (x_0 * (T + 1))

# Infinite lease

def infinite_lease(g, r, x_0):

G = (1 + g)

R = (1 + r)

return x_0 / (1 - G * R**(-1))

Now that we have defined our functions, we can plot some outcomes.

First we study the quality of our approximations

def plot_function(axes, x_vals, func, args):

axes.plot(x_vals, func(*args), label=func.__name__)

T_max = 50

T = np.arange(0, T_max+1)

g = 0.02

r = 0.03

x_0 = 1

our_args = (T, g, r, x_0)

funcs = [finite_lease_pv_true,

finite_lease_pv_approx_1,

finite_lease_pv_approx_2]

# the three functions we want to compare

fig, ax = plt.subplots()

for f in funcs:

plot_function(ax, T, f, our_args)

ax.legend()

ax.set_xlabel('$T$ Periods Ahead')

ax.set_ylabel('Present Value, $p_0$')

plt.show()

Fig. 10.1 Finite lease present value periods ahead#

Evidently our approximations perform well for small values of .

However, holding and r fixed, our approximations deteriorate as increases.

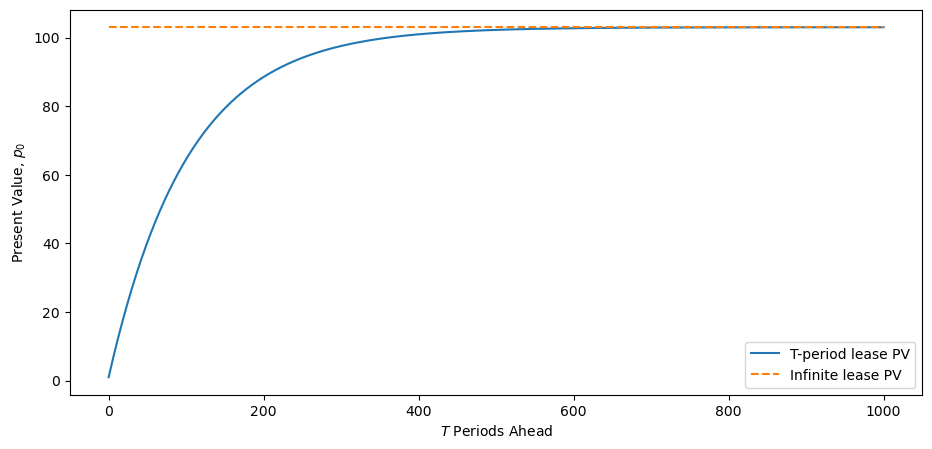

Next we compare the infinite and finite duration lease present values over different lease lengths .

# Convergence of infinite and finite

T_max = 1000

T = np.arange(0, T_max+1)

fig, ax = plt.subplots()

f_1 = finite_lease_pv_true(T, g, r, x_0)

f_2 = np.full(T_max+1, infinite_lease(g, r, x_0))

ax.plot(T, f_1, label='T-period lease PV')

ax.plot(T, f_2, '--', label='Infinite lease PV')

ax.set_xlabel('$T$ Periods Ahead')

ax.set_ylabel('Present Value, $p_0$')

ax.legend()

plt.show()

Fig. 10.2 Infinite and finite lease present value periods ahead#

The graph above shows how as duration , the value of a lease of duration approaches the value of a perpetual lease.

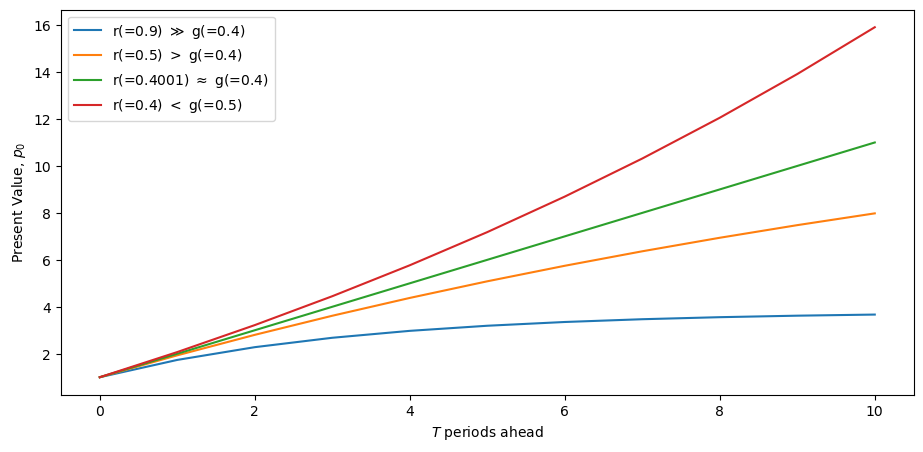

Now we consider two different views of what happens as and covary

# First view

# Changing r and g

fig, ax = plt.subplots()

ax.set_ylabel('Present Value, $p_0$')

ax.set_xlabel('$T$ periods ahead')

T_max = 10

T=np.arange(0, T_max+1)

rs, gs = (0.9, 0.5, 0.4001, 0.4), (0.4, 0.4, 0.4, 0.5),

comparisons = (r'$\gg$', '$>$', r'$\approx$', '$<$')

for r, g, comp in zip(rs, gs, comparisons):

ax.plot(finite_lease_pv_true(T, g, r, x_0), label=f'r(={r}) {comp} g(={g})')

ax.legend()

plt.show()

Fig. 10.3 Value of lease of length #

This graph gives a big hint for why the condition is necessary if a lease of length is to have finite value.

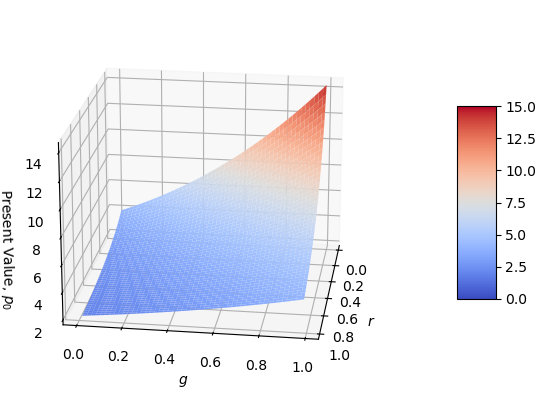

For fans of 3-d graphs the same point comes through in the following graph.

If you aren’t enamored of 3-d graphs, feel free to skip the next visualization!

# Second view

fig = plt.figure(figsize = [16, 5])

T = 3

ax = plt.subplot(projection='3d')

r = np.arange(0.01, 0.99, 0.005)

g = np.arange(0.011, 0.991, 0.005)

rr, gg = np.meshgrid(r, g)

z = finite_lease_pv_true(T, gg, rr, x_0)

# Removes points where undefined

same = (rr == gg)

z[same] = np.nan

surf = ax.plot_surface(rr, gg, z, cmap=cm.coolwarm,

antialiased=True, clim=(0, 15))

fig.colorbar(surf, shrink=0.5, aspect=5)

ax.set_xlabel('$r$')

ax.set_ylabel('$g$')

ax.set_zlabel('Present Value, $p_0$')

ax.view_init(20, 8)

plt.show()

Fig. 10.4 Three period lease PV with varying and #

We can use a little calculus to study how the present value of a lease varies with and .

We will use a library called SymPy.

SymPy enables us to do symbolic math calculations including computing derivatives of algebraic equations.

We will illustrate how it works by creating a symbolic expression that represents our present value formula for an infinite lease.

After that, we’ll use SymPy to compute derivatives

# Creates algebraic symbols that can be used in an algebraic expression

g, r, x0 = sym.symbols('g, r, x0')

G = (1 + g)

R = (1 + r)

p0 = x0 / (1 - G * R**(-1))

init_printing(use_latex='mathjax')

print('Our formula is:')

p0

Our formula is:

print('dp0 / dg is:')

dp_dg = sym.diff(p0, g)

dp_dg

dp0 / dg is:

print('dp0 / dr is:')

dp_dr = sym.diff(p0, r)

dp_dr

dp0 / dr is:

We can see that for as long as , and and is positive, so will always be negative.

Similarly, as long as , and and is positive, so will always be positive.

10.6. Back to the Keynesian multiplier#

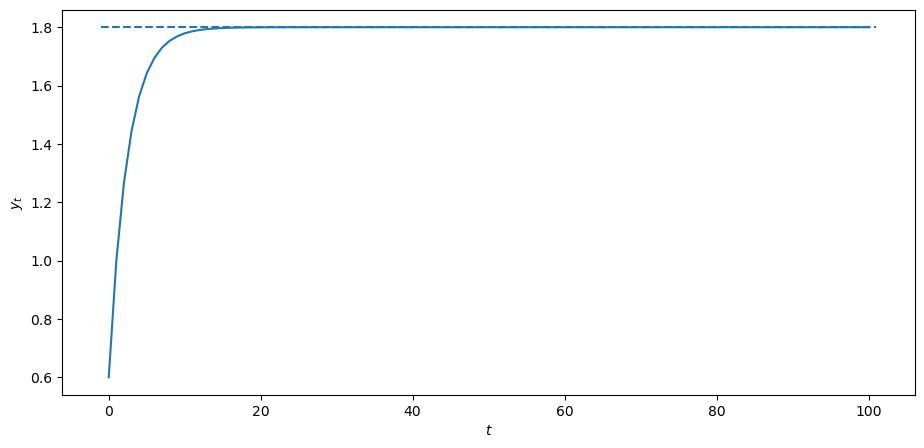

We will now go back to the case of the Keynesian multiplier and plot the time path of , given that consumption is a constant fraction of national income, and investment is fixed.

# Function that calculates a path of y

def calculate_y(i, b, g, T, y_init):

y = np.zeros(T+1)

y[0] = i + b * y_init + g

for t in range(1, T+1):

y[t] = b * y[t-1] + i + g

return y

# Initial values

i_0 = 0.3

g_0 = 0.3

# 2/3 of income goes towards consumption

b = 2/3

y_init = 0

T = 100

fig, ax = plt.subplots()

ax.set_xlabel('$t$')

ax.set_ylabel('$y_t$')

ax.plot(np.arange(0, T+1), calculate_y(i_0, b, g_0, T, y_init))

# Output predicted by geometric series

ax.hlines(i_0 / (1 - b) + g_0 / (1 - b), xmin=-1, xmax=101, linestyles='--')

plt.show()

Fig. 10.5 Path of aggregate output tver time#

In this model, income grows over time, until it gradually converges to the infinite geometric series sum of income.

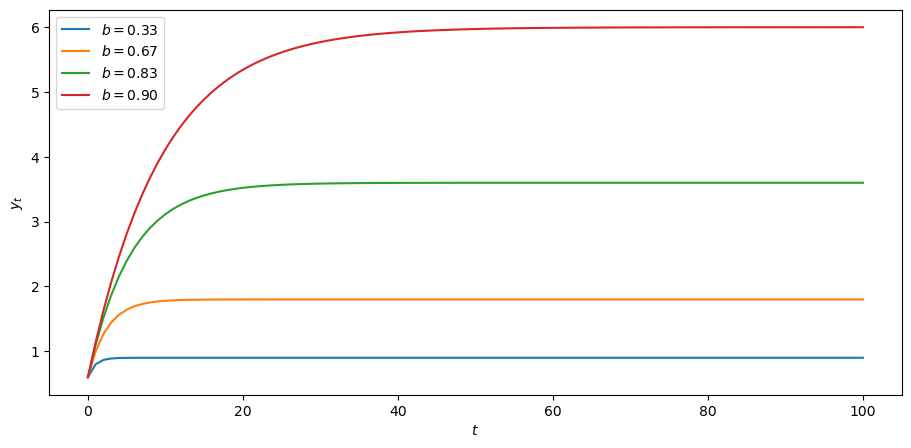

We now examine what will happen if we vary the so-called marginal propensity to consume, i.e., the fraction of income that is consumed

bs = (1/3, 2/3, 5/6, 0.9)

fig,ax = plt.subplots()

ax.set_ylabel('$y_t$')

ax.set_xlabel('$t$')

x = np.arange(0, T+1)

for b in bs:

y = calculate_y(i_0, b, g_0, T, y_init)

ax.plot(x, y, label=r'$b=$'+f"{b:.2f}")

ax.legend()

plt.show()

Fig. 10.6 Changing consumption as a fraction of income#

Increasing the marginal propensity to consume increases the path of output over time.

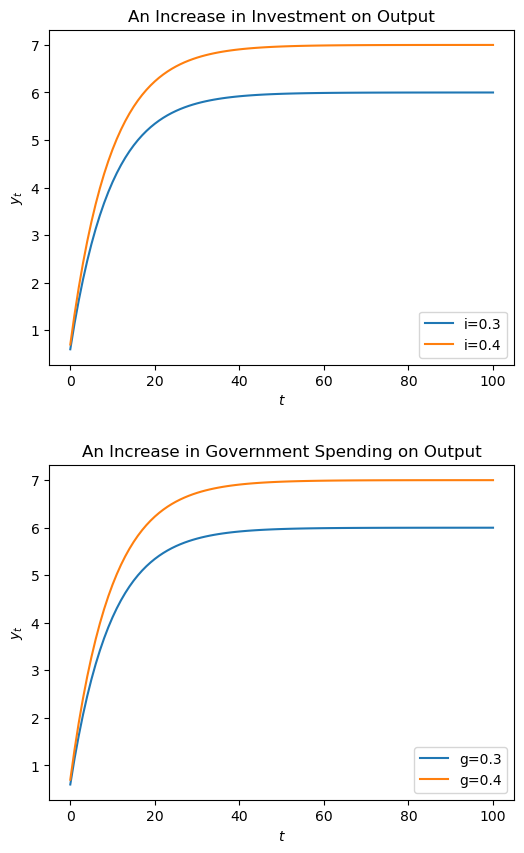

Now we will compare the effects on output of increases in investment and government spending.

fig, (ax1, ax2) = plt.subplots(2, 1, figsize=(6, 10))

fig.subplots_adjust(hspace=0.3)

x = np.arange(0, T+1)

values = [0.3, 0.4]

for i in values:

y = calculate_y(i, b, g_0, T, y_init)

ax1.plot(x, y, label=f"i={i}")

for g in values:

y = calculate_y(i_0, b, g, T, y_init)

ax2.plot(x, y, label=f"g={g}")

axes = ax1, ax2

param_labels = "Investment", "Government Spending"

for ax, param in zip(axes, param_labels):

ax.set_title(f'An Increase in {param} on Output')

ax.legend(loc ="lower right")

ax.set_ylabel('$y_t$')

ax.set_xlabel('$t$')

plt.show()

Fig. 10.7 Different increase on output#

Notice here, whether government spending increases from 0.3 to 0.4 or investment increases from 0.3 to 0.4, the shifts in the graphs are identical.